As the financial recovery begins and the property prices are ready to rise, now’s the time to invest in Samui again.

There have been important signs of a global recovery from the devastating financial crisis. Both European and Asian countries have announced that they’re coming out of a recession with Germany, France, Hong Kong and Japan leading the way. Encouraging sounds are starting to come out of the US and in the UK the housing market has finally started to pick up, suggesting that the beginnings of a worldwide recovery is imminent.

The crisis is by no means over, and everything isn’t rosy just yet. But at least for the first time in a while the optimism seems justified and widespread. But how exactly will a recovery affect things on Samui?

Well, the island should benefit in a number of ways, none of which are likely to be immediate but all will see a brighter future. The first and most obvious area of benefit will be in tourism. Those who have cancelled holidays due to lack of available funds will be desperate to make up for the disappointment of not having a vacation this year.

Thailand is as well placed as any country to take advantage of this and, with the low cost of living and great value-for-money on offer, will attract a good share of visitors. An island filled with tourists is a happy place to be and this has a knock-on effect for all other industries.

Large scale investors will be looking for destinations to invest in and at present exchange rates ensure that Thailand still represents a cheap location to buy property. This will be further enhanced by Thai banks easing the criteria for loans.

Individuals, too, are less likely to hold off their purchasing decisions and therefore make the move whilst they are in a relatively good position rather than risk losing everything like before.

As already stated, Thailand is well known as place where living costs are low; on Samui the climate is attractive and perfect for retirees. Plus, any upturn in tourism and the real-estate industry will see an increase in business and job opportunities, which will, in turn, encourage more young professionals to arrive. One thing is certain and that’s the fact that buyers will be a little more astute than in the past. The demand for high quality will be increased and buyers will seek the best value-for-money based on a combination of factors and time spent considering the purchase. The knee-jerk impulse buys are likely to be fewer than before.

Value-for-money is where the island can excel and separate itself from other emerging markets. The latest crisis will undoubtedly see investors deciding to shift their assets and move on: some people will be looking to retire, whilst others will seek to recoup some of their losses by simply putting investment into something which is likely to have a high yield.

There are other emerging markets around the world which are also cheap and offer value-for-money although none has the charm or the complete package on offer here. However, it’s a delicate time and any major incidents relating to the government could see funds being directed elsewhere.

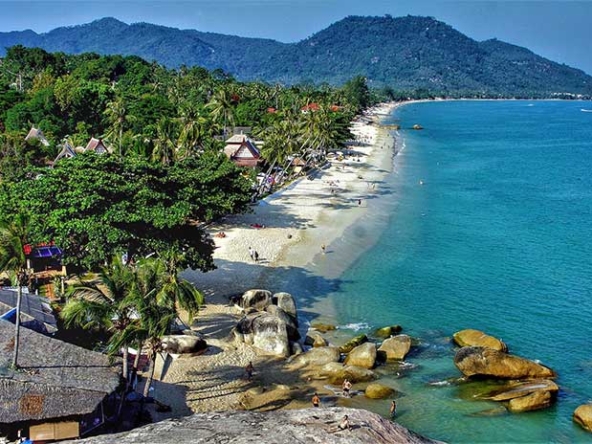

The fact that Samui has already evolved and developed into an internationally known destination is a great asset. Combine that with the confidence shown in the island by multinational hotel groups and then consider an exceptional climate, fantastic beaches, lush mountain views, an established residential and rental market, an outstanding airport linking the island to a variety of domestic and international locations and, finally, top it all off with a large cosmopolitan community and Samui will certainly head the list of potential investment locations.

The government has also shown its confidence by investing a large sum into the island’s infrastructure, which is not only positive for investors, but it will also improve the look of the island for everyone who visits.

The financial downturn came quickly; the upturn isn’t expected to take affect quite so rapidly. However, once things start to improve there’s only one way to go and this will surely start to become visible in land and house prices.

The here-and-now presents a window of great opportunity. As other economies improve, more money will once again become available for holidays and investment so buying now can only be considered a positive move. The potential for growth seems almost infinite, as was witnessed before in the island’s meteoric rise to prominence as a real-estate hot-spot.

But much more importantly, coming off the back of a major financial crisis, the potential of the investment losing is almost non-existent. It’s hard to imagine any land or property on the island continuing to lose value. In fact, they have never lost value as such; it’s just that prices have been adjusted in response to a dwindling market and buyers with less available funds.

Those who have bought during the crisis are obviously set to gain the most when the recovery is complete. But the next most beneficial group of buyers will be those who seize the opportunity now, right at the outset of that recovery.

At present, in addition to new and second-hand homes, there are a number of incomplete properties and projects just waiting for someone to snap them up and finish them off.

So, if you’re thinking of retiring in the next few years it might be worth bringing that forward to ensure you get the retirement you want. And if you were planning a relocation to live and work on Samui, now could be a good time to introduce yourself around the island in your chosen field. If you’re already here and known, it will definitely give you an advantage when positions become available. And if you want to invest in your long-term future by buying a property to let, then by buying now you are more likely to find a property which will pay for itself as well as provide a generous income.

All-in-all, the race is now on to find the best locations, the best properties and the best returns on your investments. Fortunately Samui can provide all three.