Introduction

Real estate investment strategies can be defined as structured approaches used by investors to acquire, manage, and profit from property assets. These strategies combine financial planning, market analysis, and risk management to generate income and long-term capital appreciation.

According to the National Association of Realtors (NAR), real estate remains one of the most preferred long-term investment assets due to its ability to hedge against inflation and provide consistent returns, as echoed in PwC’s Emerging Trends in Real Estate reports.

In this article, we will explore:

-

What real estate investment strategies are

-

The main types of strategies

-

Their key benefits

-

How each strategy works in practice

What Are Real Estate Investment Strategies?

Real estate investment strategies are systematic methods used to earn profit from property through rental income, appreciation, or business operations.

They involve decisions about:

-

What type of property to buy

-

How long to hold it

-

How to generate income from it

-

When to exit the investment

Unlike speculative buying, strategic investing relies on data such as:

-

Market demand

-

Rental yields

-

Financing conditions

-

Economic indicators

📊 Harvard Joint Center for Housing Studies reports that housing demand continues to rise in major urban markets due to population growth and rental affordability gaps, with similar trends noted in Zillow Research analyses.

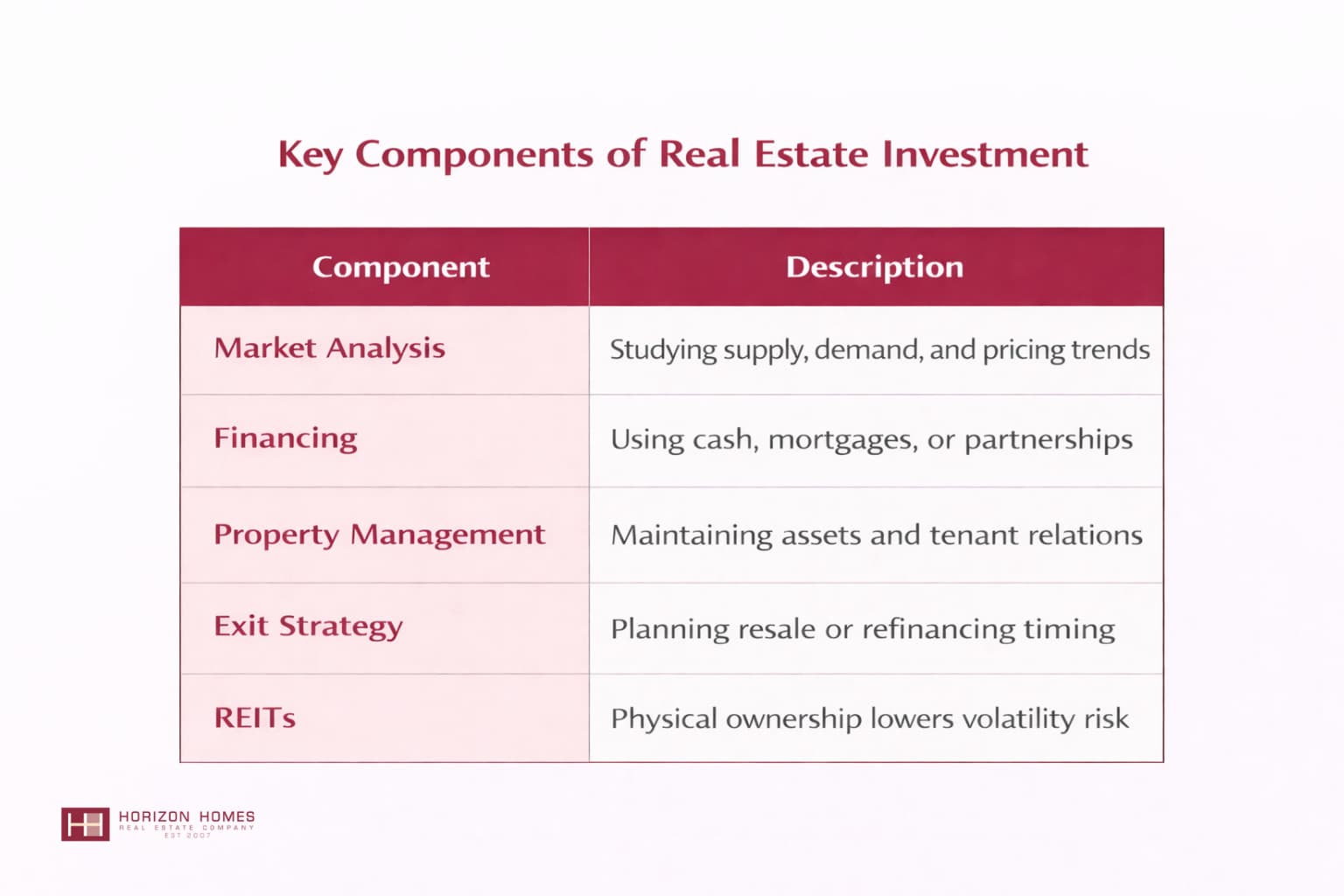

Key Components of Real Estate Investment Strategies

The key components of real estate investment strategies include market research, financing structure, asset management, and exit planning, often benchmarked using metrics like Net Operating Income (NOI) and capitalization rates (Cap Rates) from CoreLogic data.

While strong planning improves success rates, poor execution can lead to high vacancy rates and cash-flow issues.

Types of Real Estate Investment Strategies

Buy and Hold Strategy

The buy-and-hold strategy involves purchasing property and renting it out over a long period for stable income and appreciation.

This strategy benefits from:

-

Monthly rental income

-

Property price appreciation

-

Tax deductions

📌 The Urban Land Institute (ULI) notes that long-term rental assets outperform many short-term speculative investments during stable economic cycles, aligning with NAREIT (National Association of Real Estate Investment Trusts) long-term performance indices.

Pros:

-

Predictable income

-

Lower transaction costs

-

Long-term wealth building

Cons:

-

Requires maintenance

-

Exposed to market downturns

House Flipping Strategy

House flipping involves buying undervalued properties, renovating them, and selling them quickly for profit.

It relies on:

-

Accurate renovation budgets

-

Market timing

-

Quick resale

According to ATTOM Data Solutions, successful flips can generate average returns between 20–30%, depending on location and renovation efficiency.

Advantages:

-

Fast profit potential

-

High ROI per project

Disadvantages:

-

Market risk

-

High renovation costs

BRRRR Strategy (Buy, Rehab, Rent, Refinance, Repeat)

The BRRRR strategy focuses on recycling capital through refinancing after increasing property value, a method popularized by the BiggerPockets investor community.

Steps include:

-

Buy distressed property

-

Renovate it

-

Rent it out

-

Refinance

-

Reinvest

📈 Real estate finance studies show refinancing allows investors to scale portfolios faster by unlocking equity.

Benefits:

-

Rapid portfolio growth

-

Efficient use of capital

Risks:

-

Over-leveraging

-

Dependence on interest rates

Real Estate Investment Trusts (REITs)

REITs are companies that own or operate income-producing real estate and distribute profits as dividends.

They are popular because:

-

Easy to buy and sell

-

Diversified holdings

-

Low capital entry

The Securities and Exchange Commission (SEC) requires REITs to pay out at least 90% of taxable income as dividends, with performance tracked by NAREIT benchmarks.

Key Features:

-

Stock-like liquidity

-

Passive income

-

Professional management

Limitations:

-

Market volatility

-

Limited control

Real Estate Crowdfunding

Real estate crowdfunding allows multiple investors to pool funds online to finance large property projects, via platforms like Fundrise and RealtyMogul.

It enables:

-

Fractional ownership

-

Access to commercial projects

-

Portfolio diversification

📊 Crowdfunding platforms report average annual returns of 8–12%, depending on project type.

Strengths:

-

Low minimum investment

-

Hands-off investing

Weaknesses:

-

Platform risk

-

Lower liquidity

Value-Add Investment Strategy

The value-add strategy targets underperforming properties and increases their value through upgrades or operational improvements.

This strategy focuses on:

-

Renovations

-

Better management

-

Rent optimization

According to commercial real estate studies from CBRE and JLL, value-add assets can outperform stabilized assets by 2–4% annually when managed correctly.

Examples of improvements:

-

New amenities

-

Energy efficiency upgrades

-

Tenant mix optimization

Short-Term Rental Strategy

Short-term rental strategies involve renting properties for brief stays using platforms like Airbnb or Booking.com, alongside competitors like Vrbo.

This model benefits from:

-

Higher nightly rates

-

Tourism demand

-

Seasonal pricing

📉 However, municipal regulations and tourism fluctuations can significantly impact profitability.

Pros:

-

Higher income potential

-

Flexible usage

Cons:

-

High management effort

-

Regulatory risks

Land Banking Strategy

Land banking involves purchasing undeveloped land and holding it for future appreciation or development.

It depends on:

-

Urban expansion

-

Infrastructure projects

-

Zoning changes

Urban planning studies show land values rise significantly near new transport corridors.

Benefits:

-

Low maintenance

-

Long-term upside

Challenges:

-

No cash flow

-

Long holding period

Benefits of Real Estate Investment Strategies

The benefits of real estate investment strategies include income stability, wealth accumulation, and diversification.

Major Benefits:

-

Passive income generation

-

Inflation protection

-

Tax advantages

-

Asset-backed security

📊 The Federal Reserve reports that real estate represents over 30% of total household wealth in the U.S., highlighting its central role in asset portfolios, per Yale Endowment alternative investment studies.

Importance of Choosing the Right Strategy

Choosing the right strategy determines risk exposure, income stability, and scalability.

For example:

-

Conservative investors prefer REITs or buy-and-hold

-

Aggressive investors favor flipping or value-add

While high-risk strategies can yield higher returns, they can also amplify losses if market conditions shift.

Comparison of Real Estate Investment Strategies

A comparison of real estate investment strategies helps investors evaluate risk, capital requirements, and income potential.

Risks and Pitfalls of Real Estate Investment Strategies

The main risks of real estate investment strategies include market volatility, high leverage, and operational complexity.

Key Risks:

-

Market risk: Property values may fall during economic downturns

-

Liquidity risk: Properties cannot be sold quickly

-

Interest rate risk: Higher rates increase borrowing costs

-

Operational risk: Poor management leads to vacancy

📌 The International Monetary Fund (IMF) notes that housing markets are highly sensitive to interest rate changes and employment levels, as detailed in S&P Global Ratings CRE outlooks.

Market Cycle Considerations

Real estate investment performance depends heavily on economic cycles.

There are four main stages:

-

Recovery

-

Expansion

-

Hyper-supply

-

Recession

Strategic investors adjust tactics accordingly:

-

Buy undervalued assets during recovery

-

Optimize rents during expansion

-

Avoid over-leverage during downturns

📊 The World Bank identifies real estate cycles as closely linked to inflation and GDP growth trends, with models from the NAIOP Research Foundation.

Antonyms: What Poor Real Estate Strategy Looks Like

Poor real estate strategy is characterized by speculation, lack of research, and emotional decision-making.

Common mistakes include:

-

Buying without cash-flow analysis

-

Ignoring maintenance costs

-

Overpaying during booms

-

No exit strategy

While structured strategies rely on data and discipline, poor strategies rely on guesswork and trends.

Case Studies

Case Study 1: Buy-and-Hold Portfolio Growth

An investor acquired three rental properties in an urban area and held them for 7 years. Rental income increased by 35%, while property values rose by 60%.

This demonstrates the long-term compounding effect of rental strategy.

Case Study 2: Value-Add Multifamily Repositioning

A 40-unit apartment building was renovated and rebranded. Rents increased by 18%, and property value rose by 45% within 4 years.

This shows how operational improvement directly increases asset value.

Case Study 3: REIT Dividend Investing

A diversified REIT portfolio yielded an average dividend return of 6% annually, outperforming inflation and bonds.

This highlights REITs as income-oriented vehicles.

Micro Context: Related Investment Services

Real estate investment strategies are supported by professional services such as property management, brokerage, and valuation.

Related services include:

-

Property management companies

- Real estate brokers like Keller Williams

-

Mortgage lenders

-

Appraisers

-

Legal advisors

These services help reduce risk and improve performance.

Conclusion

Real estate investment strategies provide a structured path to building long-term wealth through property ownership, income generation, and smart market timing. From buy-and-hold rentals to value-add projects and passive investment options, each strategy offers distinct advantages depending on risk tolerance, capital availability, and market conditions. For investors exploring international opportunities, understanding these strategies is especially important when evaluating high-growth destinations such as Thailand’s resort markets, where tourism demand and lifestyle appeal intersect with strong investment fundamentals.

At Horizon Homes, we apply these proven strategies to help clients identify high-potential opportunities within koh samui real estate for sale, combining local market expertise with disciplined investment analysis. Whether your goal is stable rental income, capital appreciation, or portfolio diversification, choosing the right strategy — supported by professional guidance — is the foundation of successful property investing. As a next step, investors should assess their objectives, study market data carefully, and partner with experienced professionals who understand both global investment principles and the unique dynamics of Koh Samui’s property market.

Frequently Asked Questions (FAQ)

1. What is the best real estate investment strategy for beginners?

The best strategy for beginners is usually buy-and-hold or REIT investing because these approaches offer lower risk and more predictable returns. Rental properties generate steady income, while REITs provide diversification without requiring hands-on management. Horizon Homes often recommends starting with lower-volatility assets before moving into more complex strategies such as value-add or short-term rentals.

2. How do I choose the right real estate investment strategy?

Choosing the right strategy depends on your financial goals, risk tolerance, and time commitment. Long-term investors typically focus on rental income and appreciation, while short-term investors may prefer flipping or short-term rentals. Market conditions also matter—high tourism areas and developing regions may favor income-driven strategies, while mature markets suit stability-focused investments.

3. Is real estate still a good investment during economic uncertainty?

Yes, real estate can remain a strong investment during uncertain economic periods because property is a tangible asset and often provides inflation protection. Rental demand typically increases when home ownership becomes less affordable. However, investors should prioritize locations with strong fundamentals such as population growth, infrastructure development, and diversified economies.

4. Can foreign investors use these strategies in Thailand?

Foreign investors can apply most real estate investment strategies in Thailand, particularly through condominiums, leasehold structures, or company ownership models compliant with the Foreign Business Act. It is important to work with professionals who understand local regulations and zoning laws to ensure compliance and protect long-term value.

5. What makes Koh Samui attractive for real estate investment?

Koh Samui combines tourism-driven rental demand with limited land supply and strong lifestyle appeal. These factors support both rental income and long-term appreciation. Investors looking at koh samui real estate often focus on villa rentals, resort-style condominiums, and value-add properties near beaches or transport hubs.

6. How does Horizon Homes support real estate investors?

Horizon Homes assists investors by matching the right strategy with the right property, using local market data and professional due diligence. From sourcing properties and evaluating returns to coordinating legal and management services, Horizon Homes provides end-to-end support for clients seeking reliable and scalable real estate investments.