Types of real estate investments refer to the different ways individuals and institutions allocate capital into property-based assets to generate income, preserve wealth, or achieve long-term appreciation. These investments range from physical properties like homes and offices to financial instruments such as REITs and real estate funds. According to the National Association of Realtors (NAR), real estate accounts for nearly 40% of global asset value, highlighting its central role in wealth creation.

This article explains:

-

What real estate investment is

-

The main types of real estate investments

-

Their benefits and economic roles

-

Key risks and counterpoints

-

Market trends shaping these asset classes

What Is Real Estate Investment?

Real estate investment is the practice of purchasing property or property-backed assets to generate returns through rental income, resale value, or financial yields. Unlike stocks or bonds, real estate is a tangible asset that can be leased, developed, or repurposed for economic use.

As Investopedia explains, real estate investing provides both income generation and capital appreciation, often acting as a hedge against inflation.

Real estate investments are broadly divided into:

-

Direct ownership (physical property)

-

Indirect ownership (financial vehicles tied to property)

Primary Types of Real Estate Investments

1. Residential Real Estate

Residential real estate includes properties designed for people to live in, such as houses, condominiums, and apartment buildings. It is the most common entry point for investors due to familiarity and stable demand.

Examples:

-

Single-family homes

-

Condominiums

-

Duplexes and apartment complexes

-

Vacation rentals

Benefits of residential real estate include:

-

Predictable rental income

-

High tenant demand

-

Easier financing access

According to Zillow Research, long-term residential properties have historically appreciated at an average rate of 3–5% annually in developed markets.

Counterpoint:

While residential property offers stability, it can suffer from tenant turnover, maintenance costs, and rent control laws, which may reduce net returns.

2. Commercial Real Estate (CRE)

Commercial real estate refers to properties used for business activities, such as offices, retail stores, and hotels. These assets typically generate higher income than residential units due to long-term lease structures.

Major subtypes:

-

Office buildings

-

Retail centers

-

Shopping malls

-

Hotels and hospitality venues

Key advantages include:

-

Longer lease terms (5–10 years)

-

Higher rental yields

-

Professional tenant relationships

The Urban Land Institute found that commercial properties often outperform residential assets in income generation during economic expansions.

Transition:

While commercial real estate offers higher revenue potential, it is also more sensitive to economic downturns and business cycles.

3. Industrial Real Estate

Industrial real estate includes properties used for manufacturing, storage, and logistics operations. This category has expanded rapidly due to e-commerce and global supply chain growth.

Common assets:

-

Warehouses

-

Distribution centers

-

Factories

-

Data centers

Benefits:

-

Lower tenant turnover

-

Minimal interior maintenance

-

High demand from logistics firms

According to CBRE, industrial real estate demand increased by over 25% globally between 2020 and 2024, driven largely by online retail expansion.

Contrast:

Unlike residential property, industrial sites may face zoning restrictions and environmental regulations that affect development potential.

4. Land Investments (Raw and Developed Land)

Land investments involve purchasing undeveloped or partially developed land for future resale or construction. These assets generate no immediate rental income but can produce substantial long-term gains.

Types of land:

-

Agricultural land

-

Residential development land

-

Commercial development plots

Advantages:

-

Low maintenance

-

Limited depreciation

-

Scarcity value

The Lincoln Institute of Land Policy reports that land value often rises faster than constructed property during periods of urban expansion.

Risk element:

Land investments depend heavily on zoning laws, infrastructure projects, and population growth, making them speculative compared to rental properties.

Indirect Real Estate Investment Vehicles

5. Real Estate Investment Trusts (REITs)

REITs are companies that own or finance income-producing real estate and distribute profits as dividends. They allow investors to gain exposure without buying physical property.

Main REIT categories:

-

Equity REITs – own and operate property

-

Mortgage REITs – invest in real estate loans

-

Hybrid REITs – combine both strategies

According to FTSE Russell, REITs must distribute at least 90% of taxable income to shareholders, making them popular for income investors.

Analogy:

REITs function like mutual funds for buildings, pooling investor money into diversified property portfolios.

6. Real Estate Crowdfunding

Crowdfunding platforms pool small investments from many individuals to fund property projects. This lowers entry barriers and allows participation in large developments.

Common project types:

-

Apartment complexes

-

Office buildings

-

Mixed-use developments

Advantages:

-

Low minimum investment

-

Access to institutional-grade assets

-

Portfolio diversification

Harvard Business Review notes that crowdfunding has democratized property investment, particularly among millennial investors.

Trade-off:

Unlike REITs, crowdfunding investments are often illiquid and locked in for several years.

7. Fractional Real Estate Ownership

Fractional ownership allows investors to buy a portion of a property rather than the entire asset. This model is often used for luxury or high-value properties.

Use cases:

-

Resort homes

-

Commercial towers

-

High-end apartments

Benefits:

-

Reduced capital requirement

-

Shared maintenance costs

-

Exposure to premium markets

Limitation:

Decision-making can be slower due to multiple owners and legal agreements.

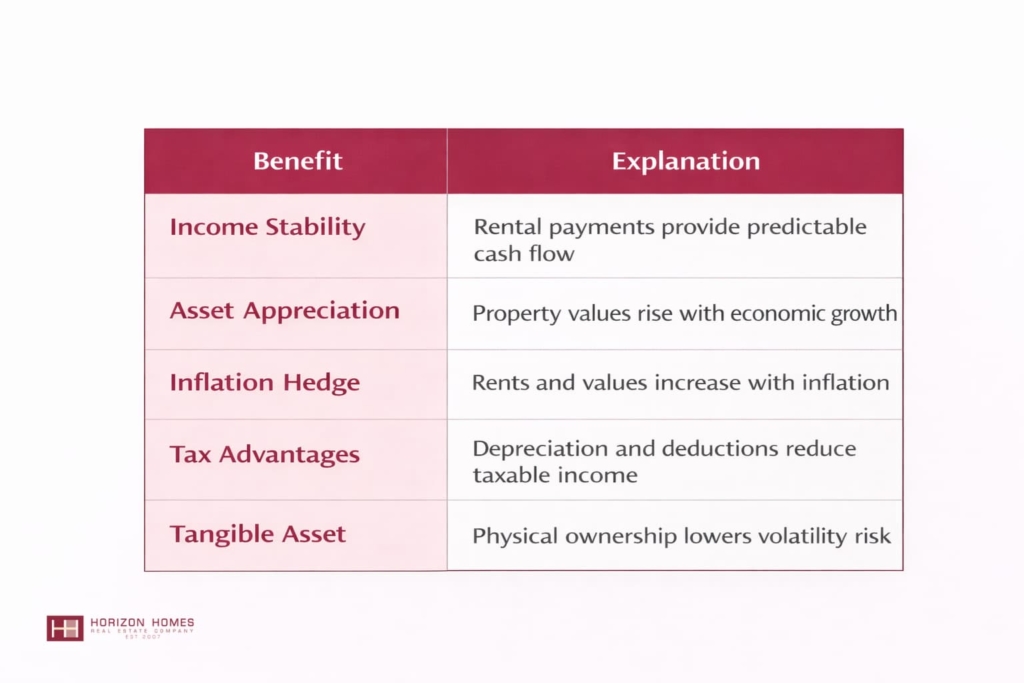

Benefits of Real Estate Investments (Macro Context – 70%)

The benefits of real estate investments include income generation, capital growth, inflation protection, and portfolio diversification.

Key Benefits Table

According to JP Morgan Asset Management, portfolios with real estate allocations show lower volatility than stock-only portfolios over long periods.

Real Estate Investment Strategies

8. Buy-and-Hold Strategy

The buy-and-hold strategy involves purchasing property and renting it out over long periods to benefit from rental income and appreciation. It is widely considered the foundation of real estate wealth-building.

Key features:

-

Long-term ownership

-

Stable cash flow

-

Compounding property value

The Federal Reserve reports that U.S. residential property prices increased by more than 120% between 2010 and 2024, illustrating the long-term potential of this strategy.

Counterpoint:

While buy-and-hold is stable, it can be impacted by market crashes, interest rate hikes, and prolonged vacancies.

9. Fix-and-Flip Strategy

Fix-and-flip investing focuses on buying undervalued properties, renovating them, and reselling at a profit. It emphasizes speed and market timing rather than long-term income.

Typical steps:

-

Identify distressed property

-

Renovate efficiently

-

Sell at market value

According to ATTOM Data Solutions, nearly 8% of U.S. home sales in 2024 involved flipping activity.

Limitation:

Unexpected renovation costs and market slowdowns can turn profitable flips into losses.

10. Real Estate Syndication

Syndication pools capital from multiple investors to acquire large properties that would otherwise be inaccessible individually.

Common assets:

-

Large apartment complexes

-

Office parks

-

Hotels

Benefits:

-

Passive income

-

Professional management

-

Lower capital per investor

Drawback:

Returns depend heavily on the competence of the managing partner.

11. Wholesaling

Wholesaling involves securing property contracts and assigning them to buyers for a fee without owning the asset. It functions more as a transaction-based strategy than a traditional investment.

Advantages:

-

Minimal capital

-

Fast returns

Risk:

Legal restrictions and contract enforcement can vary by jurisdiction.

Comparison of Major Real Estate Investment Types

|

|

||||

|

Type |

Income Potential |

Risk Level |

Liquidity |

Capital Required |

|

Residential |

Medium |

Low–Medium |

Low |

Medium |

|

Commercial |

High |

Medium–High |

Low |

High |

|

Industrial |

High |

Medium |

Low |

High |

|

Land |

Low (short-term) |

High |

Very Low |

Medium |

|

REITs |

Medium |

Medium |

High |

Low |

|

Crowdfunding |

Medium–High |

Medium |

Low |

Low |

|

Fractional Ownership |

Medium |

Medium |

Low |

Medium |

Market Trends Influencing Real Estate Investments

Digitalization of Property Markets

Digital platforms have transformed property investing through online transactions, smart contracts, and data-driven pricing models.

PwC’s Global Real Estate Outlook states that over 60% of institutional investors now use data analytics to guide property acquisition.

Growth of Industrial and Logistics Assets

E-commerce growth continues to increase demand for warehouses and distribution hubs.

According to Deloitte, logistics real estate demand grew by more than 30% between 2021 and 2024.

Rise of Fractional and Tokenized Real Estate

Blockchain-based tokenization enables investors to buy digital shares of property assets.

This trend improves liquidity and accessibility but remains subject to regulatory scrutiny.

Risks and Counterpoints (Micro Context – 30%)

Key Risks

-

Market volatility

-

Interest rate sensitivity

-

Property management complexity

-

Legal and zoning constraints

While real estate can build wealth, it can also amplify losses if leverage is misused or locations decline economically.

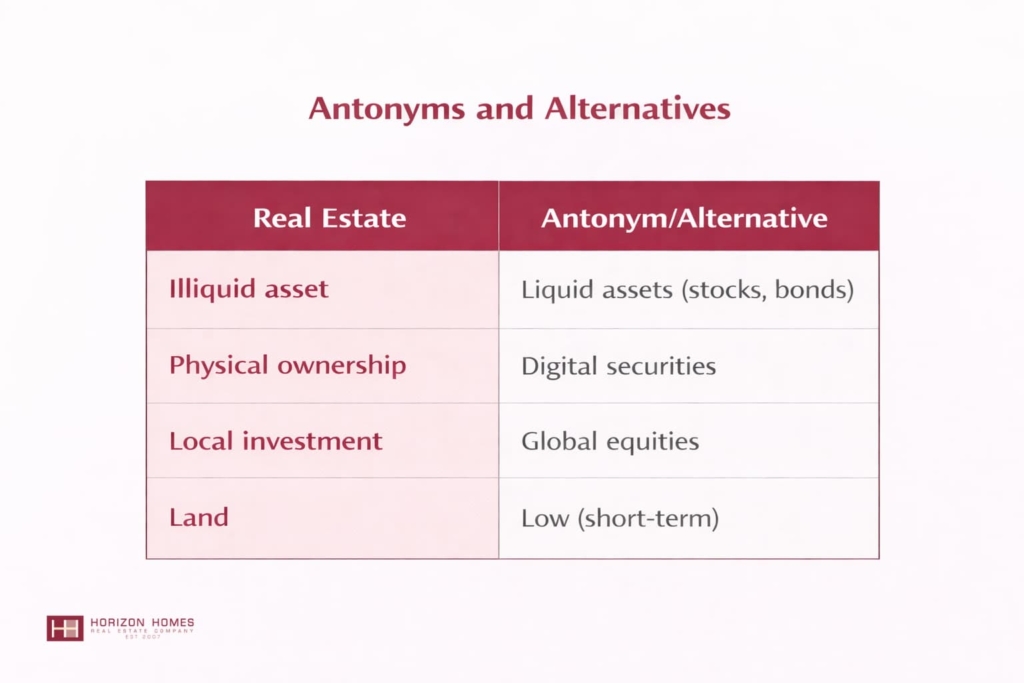

Antonyms and Alternatives

These contrasts help investors balance portfolios and reduce dependency on one asset class.

Frequently Asked Questions (FAQs)

1. What is the safest type of real estate investment?

Residential rental property and REITs are often considered the safest due to consistent demand and diversification.

2. Which real estate investment yields the highest returns?

Industrial and commercial properties typically offer higher yields but also carry higher risks.

3. Can beginners invest in real estate without buying property?

Yes. REITs and crowdfunding platforms allow small-scale participation with low capital.

4. Is land a good investment?

Land can offer high appreciation but lacks income generation, making it speculative.

Conclusion

At Horizon Homes, we believe understanding the different types of real estate investments is the foundation of smart property decisions. From residential rentals and commercial assets to land and indirect vehicles like REITs, each investment type serves a distinct financial purpose—whether that is generating income, preserving capital, or achieving long-term growth. By matching the right asset class with your risk profile and lifestyle goals, investors can build a diversified portfolio that performs across market cycles.

For those looking to turn strategy into action, especially in high-demand island markets, professional guidance is essential. Whether your focus is lifestyle ownership or income potential, Horizon Homes specializes in helping buyers navigate koh samui real estate for sale with clarity and confidence. Our team connects global investors with carefully selected opportunities, local market insight, and end-to-end support—so every investment decision is grounded in knowledge, not guesswork.