The real estate market in Koh Samui continues to offer a wealth of investment opportunities for 2024 and beyond. Known for its stunning beaches, lush landscapes, and luxury lifestyle, Koh Samui stands apart from other Thai destinations like Pattaya, Bangkok, and Hua Hin due to its unique environmental regulations and exclusive high-end appeal. In this article, we’ll explore the current trends, market dynamics, and what the future holds for investors looking to buy property in Koh Samui, with a particular focus on 2025.

Overview of the Koh Samui Property Market

Real estate prices and trends in Koh Samui vs. other popular Thai destinations

| Location | Average Price Range (THB) | Price per Square Meter (THB) | Popular Property Types | Market Trends |

| Koh Samui | 20–40 million (Luxury Villas) | 150,000–200,000 | Villas, Beachfront Homes | High-end villa demand; limited condo options; demand for sea-view properties. |

| Bangkok | 7–25 million (Luxury Condos) | 250,000–350,000 (Central) | High-rise Condos | The central luxury condo market remains strong; suburban condos are more affordable. |

| Pattaya | 2–5 million (Condos) | 90,000–140,000 | Condos, Beachfront Apartments | Affordable condo market; popular for vacation homes and rentals post-pandemic. |

| Hua Hin | 10–12 million (Beachfront Villas) | 250,000 | Villas, Beachfront Homes | Steady demand; retirees and long-term residents favor beachfront luxury villas. |

Unique Environmental Regulations: Protecting Island Charm

One of the main reasons Koh Samui’s real estate market stands out is its strict environmental building regulations. Construction is limited to three floors and a maximum height of 12 meters, ensuring the island avoids the high-rise skylines that characterize destinations like Bangkok and Pattaya. These regulations preserve the island’s tropical beauty, helping maintain its appeal to both tourists and high-net-worth individuals.

Moreover, Koh Samui has placed restrictions on condominium developments, making them increasingly rare. This has led to higher demand for luxury villas and beachfront properties, as the island’s natural landscape is preserved from the overdevelopment seen in other parts of Thailand.

2024 Property Market Trends in Koh Samui

Demand for Luxury Properties

As of 2024, Koh Samui continues to attract affluent buyers from Europe, Hong Kong, and Australia. These buyers are primarily looking for holiday homes and rental investment properties. The market’s luxury segment is particularly strong, with high-end properties in the THB 20–40 million range (USD 600K–1.2M) making up a significant portion of sales.

Price Trends

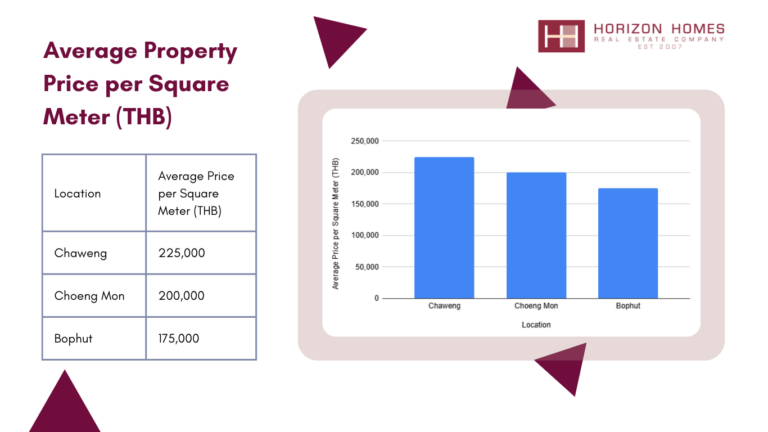

According to the Bank of Thailand, the average price per square meter for real estate on Koh Samui hovers around $4,500. However, prices vary based on location, with premium areas like Chaweng, Choeng Mon, and Bophut seeing higher valuations, while more rural areas offer relatively lower prices. Luxury beachfront villas command the highest prices due to their location and exclusivity. Yet, compared to international markets, Koh Samui remains an attractive bargain, with prices approximately 21% lower than in Bangkok.

Rental Market

Koh Samui’s rental market is thriving in 2024, with many investors targeting holiday rentals due to the island’s high tourist traffic. Properties offering rental yields above 7% are highly sought after, especially in popular tourist areas like Bophut, Plai Laem, and Chaweng Noi. Luxury villas, beachfront homes, and sea-view condos are particularly popular for short-term rentals, drawing interest from tourists seeking privacy, scenic views, and access to Koh Samui’s natural beauty.

Impact of COVID-19 on Market Recovery

The COVID-19 pandemic had a temporary cooling effect on the Koh Samui property market, causing a dip in transactions during 2020 and 2021. However, the market has rebounded as international travel restrictions eased, with renewed demand from expatriates and wealthy individuals seeking safe, serene retreats. The rise of remote work has also driven interest in larger homes with outdoor spaces, positioning Koh Samui as an ideal destination for those wanting a blend of work and leisure.

Future Trends for Koh Samui Real Estate in 2025

Continued Demand for Sustainable and Eco-Friendly Properties

As environmental consciousness grows worldwide, eco-friendly real estate is becoming increasingly popular. Properties built with sustainable materials, solar panels, and natural ventilation are expected to see higher demand, both from domestic buyers and international investors looking for sustainable luxury. This trend is expected to strengthen in 2025, particularly as developers begin to focus on low-impact developments that blend with the island’s natural beauty.

Growth in Managed Properties and Off-Plan Developments

The shift toward fully managed villa developments and off-plan projects is likely to accelerate in 2025. These developments provide a hassle-free ownership experience, offering rental management services and guaranteed returns on investment (ROIs). Buyers are increasingly attracted to such arrangements as they offer both a holiday home and a reliable income stream when the property is rented out.

Increasing Affluence of Buyers

The luxury real estate market will continue to dominate Koh Samui’s property trends into 2025. Expect a growing influx of Westernized homes catering to the preferences of international buyers, with features like modern appliances and Western-style kitchens becoming standard in new developments. Retirees and expatriates from Europe, Hong Kong, and Australia will continue to be key market players, drawn by Koh Samui’s tranquility, luxury, and affordable real estate compared to their home markets.

Rising Popularity of Urban Properties

While beachfront properties have always been in demand, urbanization trends in Koh Samui are also shaping the market. Areas like Bophut Hills and Chaweng Noi are witnessing sharp price increases, driven by stunning sea views and proximity to popular tourist spots. In 2025, expect more focus on vacation homes and condominiums in these areas, offering investment potential for those interested in renting out their properties when not in use.

Expanding Flight Connectivity

As flight connections to Koh Samui improve, with more frequent routes from international hubs, the island’s appeal to foreign buyers will only grow. Increased accessibility will continue to attract a global audience, further boosting property demand and driving market growth into 2025 and beyond.

Is It Time to Buy Property in Koh Samui?

For those considering an investment in 2024 or 2025, Koh Samui presents a unique opportunity. With strict environmental protections limiting overdevelopment, strong demand for luxury and eco-friendly properties, and a rebounding economy, property values are set to rise. Whether you’re seeking a second home, rental property, or a retirement retreat, now is the ideal time to buy.

Key Takeaways:

- Luxury properties and beachfront villas continue to dominate the market.

- Sustainable homes and eco-friendly developments are on the rise.

- Rental yields remain strong, especially in high-demand areas like Bophut and Chaweng.

- Flight connectivity and tourism growth are key drivers for future demand.

- 2025 will see continued growth, with a focus on high-end developments, managed properties, and urbanization trends.

Is It Better to Rent or Buy in Koh Samui?

The decision between renting or buying property in Koh Samui depends on several factors, including your financial situation, long-term plans, and lifestyle preferences. Both options have their advantages, so here’s a breakdown to help you decide:

Buying Property in Koh Samui

Buying property on Koh Samui can be a smart investment due to the island’s growing real estate market and high demand for luxury rentals. Here’s why you might consider purchasing:

- Appreciating Asset: Koh Samui’s property values are expected to continue rising, especially in high-demand areas like Bophut, Plai Laem, and Chaweng Noi. Buying now could offer significant capital gains in the future.

- Rental Income: If you plan to rent out the property, you can generate a steady stream of passive income, especially if your property is in a desirable location. Properties offering rental yields of over 7% are common in key areas.

- Long-Term Savings: Owning a property eliminates monthly rent payments and allows you to build equity over time. It can also serve as a retirement home or second home for regular visits.

- Tax Benefits: In some cases, property ownership may come with certain tax advantages, depending on local regulations and your country of residence.

However, foreign buyers must navigate Thailand’s property laws, as land ownership is restricted. You may opt for a leasehold or buy a condominium, which is more straightforward for non-residents.

Renting Property in Koh Samui

If you’re not ready for the commitment of buying or want to test out living on the island before making a purchase, renting is a flexible and convenient option:

- Flexibility: Renting gives you the freedom to move without the long-term financial commitment of buying. This is ideal for expats, digital nomads, or those planning shorter stays on the island.

- Lower Initial Cost: Renting doesn’t require the large upfront costs associated with buying property, such as down payments, legal fees, or taxes. For those on a budget, it’s a more accessible way to enjoy island living.

- Access to Luxury: Renting allows you to experience luxury living without the need for a large capital investment. You can enjoy high-end villas or beachfront condos while keeping your options open.

- No Maintenance Hassles: As a renter, you won’t have to worry about the upkeep or maintenance costs that come with owning a property. The landlord typically handles these expenses.

Ultimately, if you’re planning to stay on the island long-term and have the financial means, buying property could offer better financial rewards. However, if you’re seeking flexibility or don’t want the responsibility of ownership, renting is a great option.

Types of Properties to Buy in Koh Samui

Koh Samui’s property market offers a diverse range of options to suit different preferences and investment strategies. Whether you’re looking for a luxury retreat, investment property, or commercial venture, the island has properties that cater to all. Some key property types include:

- Luxury Villas: Ideal for those seeking privacy, comfort, and stunning views. Villas on Koh Samui often come with private pools and expansive living areas, making them perfect for personal use or luxury rentals.

- Beachfront Homes: These properties provide direct access to the beach, combining seclusion with breathtaking ocean views. They are highly sought after by both buyers and vacation renters.

- Condominiums: While condo developments are rare due to building regulations, they offer an affordable entry point into the market. Condos with sea views and modern amenities are especially popular among foreign investors.

- Hillside Properties: Properties located on the hills offer panoramic views of the sea and the island’s natural landscape. They are ideal for those wanting a serene, secluded getaway.

- Commercial Properties: For investors interested in opening a business, Koh Samui offers a range of commercial real estate such as resorts, restaurants, and boutique hotels. Tourism drives the demand for these types of investments, making them a lucrative option.

Whether you’re looking for a luxury villa, a sea-view condo, or a commercial investment, the Koh Samui property market has something for everyone.

Conclusion

The Koh Samui property market is well-positioned for growth in 2024 and 2025, driven by luxury real estate demand, eco-friendly development trends, and increasing interest from international buyers. Whether you are an investor seeking high returns or looking for a dream holiday home, Koh Samui offers a unique blend of tropical beauty, affordability, and luxury living. Investing now means tapping into a market that is likely to see continued appreciation as more affluent buyers look to secure a piece of this island paradise.

For further insights into Koh Samui’s real estate market, explore Conrad Properties’ portfolio of available homes, villas, and investment opportunities on the island. Start your property search today and capitalize on the growing market!