Thailand offers a vibrant real estate market that has become increasingly attractive to foreign investors. With a mix of high returns, economic stability, and a welcoming visa policy, investing in Thailand’s property market presents numerous opportunities. The average return on property investments in Thailand, specifically in Koh Samui, ranges from 7% to 10%. Villas typically yield returns of up to 30%, while condos offer returns of up to 25%.

This comprehensive guide will delve into the essentials of investing in Thailand, covering everything from property types and legalities to market potential and investment strategies.

Overview of Thailand Property Investment

Thailand’s property market is known for its affordability and high potential returns. The country’s economic growth, tourism industry, and attractive lifestyle options make it a prime destination for property investment. Foreign investors can benefit from a variety of property types, each with unique advantages and regulations.

Importance for Foreign Investors

Foreign investors play a crucial role in Thailand’s property market. By understanding the local regulations and market trends, they can make informed decisions that yield significant returns. Thailand’s strategic location in Southeast Asia and its pro-investment policies further enhance its appeal to international buyers.

Real Estate Investment For Locals

Local Thai investors have unique advantages and opportunities within the property market. With fewer restrictions and deeper market familiarity, Thai citizens can leverage these benefits to maximize their investment returns.

Investment Options

Thai nationals can invest in a wider range of properties, including both freehold and leasehold land, houses, villas, and condominiums without the ownership restrictions faced by foreigners. This provides greater flexibility and opportunities for diversification.

Popular Investment Types

- Houses and Villas: Full ownership of houses and villas is available to Thai nationals, offering both residential and rental income opportunities. Sea-view villas command higher prices, starting at around ฿10 to ฿12 million ($281,000 to $337,000), and the most luxurious beachfront villas can reach prices of ฿30 to ฿40 million ($843,000 to $1 million).

- Condominiums: Like foreigners, locals can invest in condominiums, but they can own more than 75% of the units in any given building. Condos offer a range of options, with one-bedroom units averaging around ฿3 million ($94,000) and three-bedroom units up to ฿20 million ($625,000), depending on location and amenities.

- Land: Thai citizens can purchase freehold land, which can be developed or held for long-term appreciation. Land prices fall anywhere between ฿1.1 million ($30,000) and ฿990 million ($27 million).

Market Trends

The Thai property market for locals is influenced by various factors, including economic conditions, urbanization, and government policies. Key trends include the rise of mixed-use developments and increasing demand for properties in emerging suburban areas.

Emerging Trends

- Urbanization: Rapid urbanization is driving demand for residential properties in and around major cities like Bangkok and Chiang Mai.

- Suburban Growth: As cities become more congested, suburban areas are seeing increased interest and development, offering more affordable investment options.

Legal Considerations

Local investors benefit from straightforward property laws and reduced bureaucratic hurdles compared to foreign investors. They also have greater access to financing options through Thai banks, making property acquisition more accessible.

Legal Benefits

- Simplified Transactions: Fewer legal complexities and restrictions for property ownership.

- Financing Options: Access to a wider range of mortgage products and financing from local banks.

Real Estate Investment For Foreigners

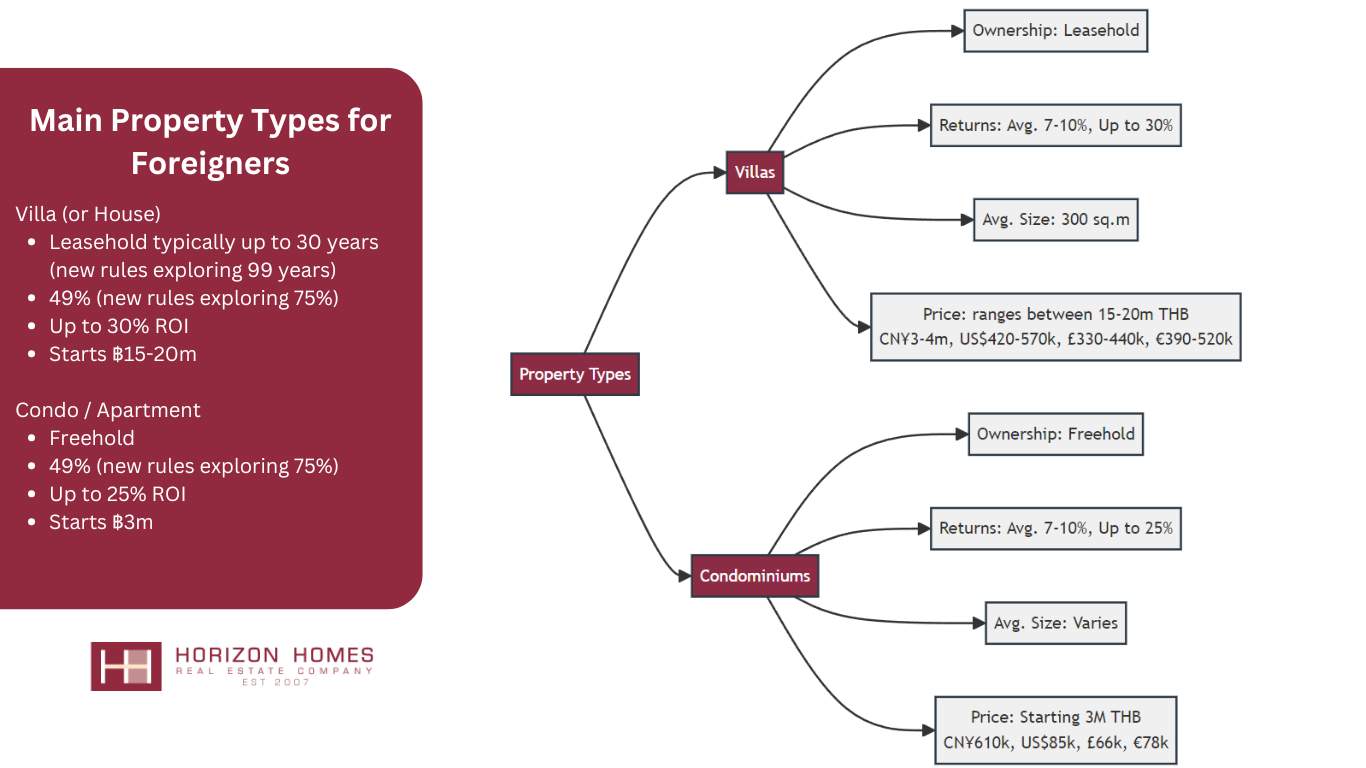

Foreigners can invest in two main types of properties in Thailand: villas and condominiums. Understanding the distinctions between these options and the associated legal frameworks is crucial for making informed investment decisions.

Villas

Villas in Thailand, especially in popular locations like Koh Samui, offer luxurious living with features such as sea views, infinity pools, and spacious layouts. These properties can be highly profitable, especially when located in prime areas.

Standard Villa Characteristics

A standard villa in Koh Samui typically consists of three bedrooms on a hillside with a sea view, an infinity pool, and covers an area of about 300 square meters. The price for such villas generally ranges between 15-20m THB (CN¥3-4m, US$420-570k, £330-440k, €390-520k). If it is a beachfront villa, you could expect the price to be doubled. As the land size or livable area increases, the price will also increase. The land resources of Koh Samui are becoming scarcer, so we expect prices to increase over time too.

Price Range and Factors Affecting Prices

The price of villas in Koh Samui is influenced by several factors:

- Location: Hillside villas are typically cheaper than beachfront properties.

- Amenities: Features like infinity pools and sea views add to the property’s value.

- Land Scarcity: As land becomes more scarce, property prices are expected to rise.

Condos

Condos are often the more accessible option for foreigners due to the more straightforward ownership regulations. Foreigners can own up to 75% of the units in a condominium project, making this an attractive investment.

Advantages of Off-Plan Condos

Buying an off-plan condominium unit can be advantageous due to the lower initial prices. However, potential investors must consider the wait time for construction completion and the risks associated with project delays.

Disadvantages of Off-Plan Condos

While prices are lowest at the pre-construction stage, there is always the risk of delays or non-completion. It is essential to research the developer’s track record and project timelines.

All Fine Decoration

Buying an off-plan condominium unit can be advantageous due to the lower initial prices. However, potential investors must consider the wait time for construction completion and the risks associated with project delays.

Advantages of Off-Plan Condos

- Lower Initial Prices: Off-plan condos are typically priced lower than completed units, offering a cost-effective entry point for investors.

- Potential for Higher Returns: As the project progresses and nears completion, the value of the units often increases, providing potential for significant returns on investment.

Disadvantages of Off-Plan Condos

- Construction Delays: There is a risk of delays or even non-completion of the project, which can impact the investment timeline.

- Market Fluctuations: Changes in the market conditions during the construction period can affect the property’s value and rental potential.

Property Rights

Property rights for foreigners in Thailand vary based on the type of property and ownership structure.

Freehold Property Rights

Foreigners can own freehold condominium units, which come with permanent property rights that can be bought and sold freely. This makes condominiums a popular choice for foreign investors looking for stability and long-term investment potential.

Benefits of Freehold Ownership

- Permanent Ownership: Freehold ownership provides permanent rights to the property, offering long-term security for investors.

- Transferability: Freehold properties can be easily transferred or sold, providing flexibility for future investment decisions.

Leasehold Property Rights

For properties that exceed the 75% foreign ownership cap or for villas, foreigners can only obtain leasehold rights, typically up to 30 years, with possible extensions. This option is more common for villa purchases where land ownership restrictions apply.

Understanding Leasehold Ownership

- Lease Terms: Leasehold agreements are typically for 30 years, with options for renewal.

- Ownership Limitations: While the building can be owned by a foreigner, the land remains under a lease agreement with the landowner.

Foreign Ownership Regulations

Foreign investors must navigate specific regulations that dictate ownership percentages and the structuring of ownership through Thai companies. For instance, foreign ownership in a condominium project is capped at 75% of the total units, and owning a villa often requires setting up a Thai Limited Company.

Navigating Ownership Regulations

- Ownership Cap: Foreigners can own up to 75% of the units in a condominium project.

- Company Structuring: For villas, setting up a Thai Limited Company with Thai shareholders is a common strategy to comply with ownership regulations.

Taxation

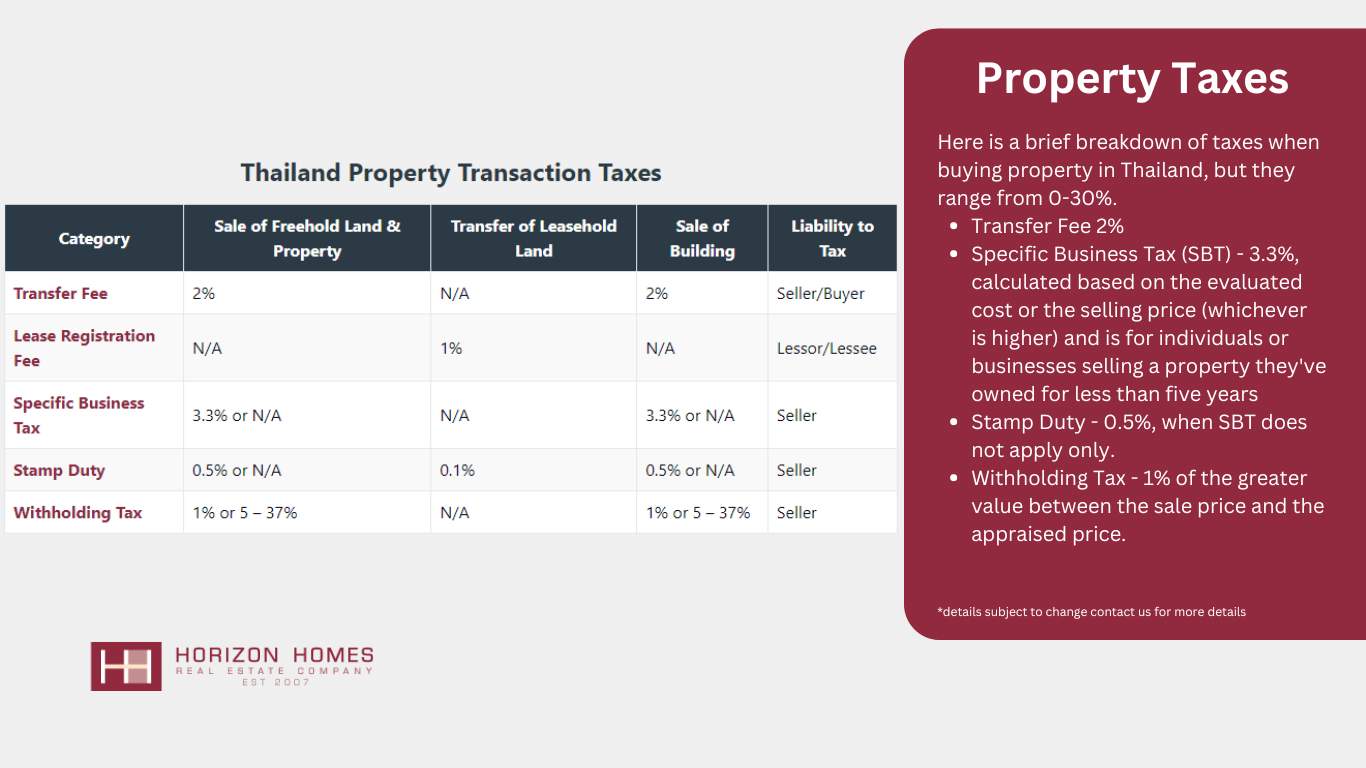

When purchasing property in Thailand, investors must consider the various taxes imposed by the Land Department.

Transfer Fee

A 2% fee based on the unit price is payable to the Land Department. This fee is usually shared between the buyer and the seller.

Calculating the Transfer Fee

- Percentage of Property Value: The transfer fee is calculated as 2% of the property’s unit price.

- Shared Responsibility: The fee is typically split between the buyer and the seller, depending on the agreement with the developer.

Special Business Tax

A 3.3% tax is applicable under certain conditions, particularly when the property is sold within five years of purchase.

Applicability of Special Business Tax

- Short-Term Sales: The tax applies to properties sold within five years of purchase.

- Tax Calculation: The tax is 3.3% of the property’s unit price.

Stamp Duty

A 0.5% duty is also levied on the property transaction. The combined taxes amount to around 6.3% of the property value, with the split between buyer and seller varying based on developer agreements.

Understanding Stamp Duty

- Percentage of Property Value: Stamp duty is calculated as 0.5% of the property’s unit price.

- Total Tax Burden: The total tax burden, including transfer fee and special business tax, amounts to approximately 6.3% of the property’s value.

Tax Splitting Methods

Developers may use different methods to split these taxes between buyers and sellers, affecting the overall cost for the investor. Some developers absorb a portion of these costs to attract more buyers.

Developer Agreements

- Tax Splitting: The method of splitting taxes between buyer and seller can vary based on the developer’s policy.

- Incentives for Buyers: Developers may offer incentives, such as absorbing part of the tax burden, to attract foreign investors.

Sinking Funds

A sinking fund is a one-time expense required to cover future repair or improvement costs for the property. The amount depends on the condominium’s size and is paid upon delivery.

Purpose of Sinking Funds

The sinking fund serves as a reserve for major repairs or replacements that might be needed in the future, such as repainting the building or replacing shared facilities.

Importance of Sinking Funds

- Future Repairs: The fund ensures that there are sufficient resources for major repairs or improvements.

- Property Maintenance: Maintaining the property’s condition helps preserve its value and attractiveness to tenants.

Calculation Based on Size

The amount is calculated based on the condominium’s size, typically quoted per square meter. This ensures that larger units contribute a proportionate amount to the fund.

Payment Terms

- One-Time Payment: The sinking fund is a one-time payment made upon delivery of the condominium.

- Based on Size: The amount is proportional to the size of the unit, ensuring fairness in contributions.

Maintenance Fees

Ongoing maintenance fees cover daily operational costs, such as security, cleaning, and pool maintenance. These fees are typically paid annually in advance.

Day-to-Day Operation Costs

Maintenance fees ensure that the property is well-maintained and operational costs are covered. This includes salaries for security and cleaning staff, as well as upkeep for common areas and amenities.

Coverage of Maintenance Fees

- Operational Costs: Fees cover costs such as security, cleaning, and maintenance of common areas.

- Annual Payment: Maintenance fees are typically paid annually in advance to ensure continuous upkeep.

Annual Pre-Payment Requirements

Most developers require a pre-payment of the annual maintenance fee upon delivery of the condominium. Subsequent payments are made annually in advance to ensure continuous maintenance.

Pre-Payment Structure

- Initial Pre-Payment: The first year’s maintenance fee is often required at the time of property delivery.

- Annual Renewal: Maintenance fees are renewed annually, with payments made in advance.

Samui Villas: Investment Market and Potential Returns

Investing in villas on Koh Samui can be highly lucrative, with properties often featuring luxurious amenities and stunning views.

Standard Villa Characteristics

A typical villa in Koh Samui includes three bedrooms, a hillside or beachfront location, and an infinity pool, covering around 300 square meters.

Detailed Features

- Bedrooms: Three spacious bedrooms provide ample living space.

- Location: Prime hillside or beachfront locations offer breathtaking views.

- Amenities: Infinity pools and modern designs enhance the property’s appeal.

Price Range

Hillside villas typically range between three to four million Chinese Yuan, while beachfront villas can cost twice as much. The scarcity of land on the island contributes to increasing property prices over time.

Factors Influencing Prices

- Location: Beachfront properties command higher prices due to their premium location.

- Amenities: Additional features such as pools and sea views increase the property’s value.

- Land Availability: Limited land resources drive up property prices, making early investments potentially more profitable.

Factors Affecting Prices

Land scarcity, location, and the level of amenities provided significantly impact villa prices. As land becomes scarcer, prices are expected to continue rising, making early investments potentially more profitable.

Market Trends

- Rising Prices: Increasing demand and limited land availability contribute to rising property prices.

- Investment Timing: Early investment can lead to significant returns as property values appreciate over time.

Managing a Rental Villa

Investors in rental villas have two primary management options: professional management companies or developer management services.

3 bed 3 bath Villa For Rent in Choeng Mon – HV0083

- ฿6,000/per night

- Beds: 3

- Baths 3

yes

yes- Villa

2 bed 3 bath Villa For Rent in Chaweng Noi – HR0057

- ฿4,000/per night

- Beds: 2

- Baths 3

yes

yes- Villa

4 bed 4 bath Villa For Rent in Mae Nam – HV0119

- ฿11,000/per day

- Beds: 4

- Baths 4

yes

yes yes

yes- Villa

Professional Management Companies

These companies handle all aspects of property management, providing peace of mind for overseas investors. They typically charge a fixed fee and work with reservation websites or travel agents to secure bookings.

Services Offered

- Property Management: Comprehensive management services, including maintenance and tenant relations.

- Marketing: Effective marketing strategies to attract tenants and maximize occupancy rates.

- Booking Management: Collaboration with reservation websites and travel agents to secure bookings.

Developer Management Services

Developers often offer management services, ensuring a seamless transition from purchase to rental. This can be beneficial as developers have a vested interest in maintaining high occupancy rates.

Developer-Led Management

- Seamless Transition: Developers facilitate a smooth transition from purchase to rental management.

- Occupancy Focus: Developers are motivated to maintain high occupancy rates to attract future buyers.

Occupancy Rates

Occupancy rates significantly impact rental income. Effective marketing can boost occupancy, leading to returns between 5% and 20% annually.

Maximizing Returns

- High Occupancy: Properties with high occupancy rates can yield returns of 10%-20% annually.

- Effective Marketing: Strategic marketing efforts are crucial to achieving high occupancy and maximizing rental income.

Overseas Investment Threshold Conditions

Investing in Thailand requires meeting certain conditions, but the process is relatively straightforward for those prepared.

Requirements for Buying Property

Foreign investors need a valid passport and sufficient funds to purchase property. These are the primary requirements, with additional documentation varying based on the type of property and investment structure.

Documentation and Funds

- Passport: A valid passport is required for property purchase.

- Proof of Funds: Sufficient funds must be available to complete the transaction.

Legal Rights Protection

Foreign investors have the same rights as Thai nationals for freehold condominiums, ensuring their investments are protected. Understanding the legal landscape and working with reputable legal advisors is crucial.

Protecting Investments

- Equal Rights: Foreign investors enjoy the same property rights as Thai nationals for freehold condominiums.

- Legal Advice: Consulting with legal experts helps navigate the regulatory landscape and protect investments.

Passport and Funds

Only a passport and necessary funds are required to invest in property in Thailand. Property rights can be transferred without inheritance taxes, and long-term visas are available for residents.

Necessary Documents and Funds

Investors need to provide a valid passport and proof of funds to complete the property purchase. This straightforward requirement simplifies the buying process for foreigners.

Simplified Requirements

- Passport: The primary document needed for property purchase.

- Funds: Availability of sufficient funds to cover the purchase price and associated costs.

Property Rights Transferability

Property rights in Thailand are transferable and can be inherited without incurring inheritance taxes, providing long-term security for investors and their heirs.

Long-Term Security

- Transferable Rights: Property rights can be easily transferred or inherited.

- No Inheritance Tax: Property transfers are not subject to inheritance taxes, offering financial benefits.

Freehold Land or Villa Purchase via a Thai Ltd Company

Foreigners can own buildings but not the land in their name. Setting up a Thai Ltd Company is a common strategy to overcome this limitation.

Company Structure

A typical company structure involves the foreign investor as the sole director with 49% ownership, while a business in Thailand must be at least 51% owned by a Thai national. There are exceptions if you obtain a Foreign Business License or you explore BOI.

Structuring the Company

- Director Role: The foreign investor acts as the sole director, managing the company.

- Shareholding: Thai shareholders hold 51% of the shares, complying with local regulations.

Shareholding Regulations

The company structure protects foreign investors’ interests while complying with Thai law. The foreign director maintains control over the company’s decisions.

Regulatory Compliance

- Ownership Limits: Foreign ownership is capped at 49%, with Thai shareholders holding the majority.

- Control Mechanisms: The foreign director retains control over company decisions, ensuring investment security.

Leasing Land

Foreigners can lease land from their company, ensuring control over the property. Lease agreements are typically for 30 years, with options for renewal.

Leasing Arrangements

- Lease Terms: Leases are typically for 30 years, with renewal options available.

- Control Over Property: Leasing land through the company structure ensures the foreign investor retains control.

Leasehold Purchase

Leasehold properties can be registered for up to 30 years, with contractual extensions available. These leases must be registered at the land office for each renewal period.

Registration and Renewal Process

Leasehold agreements require registration at the land office, and extensions must also be registered to remain valid. This ensures legal compliance and protects the investor’s interests.

Legal Requirements

- Registration: Lease agreements must be registered at the land office.

- Renewal: Contractual extensions must also be registered to ensure validity.

Guidance and Legal Advice

Professional legal advice is recommended to navigate the complexities of leasehold purchases and ensure all agreements are properly registered and enforceable.

Importance of Legal Guidance

- Complex Transactions: Leasehold purchases can be complex, requiring professional legal assistance.

- Protecting Interests: Legal advice ensures agreements are enforceable and protect the investor’s interests.

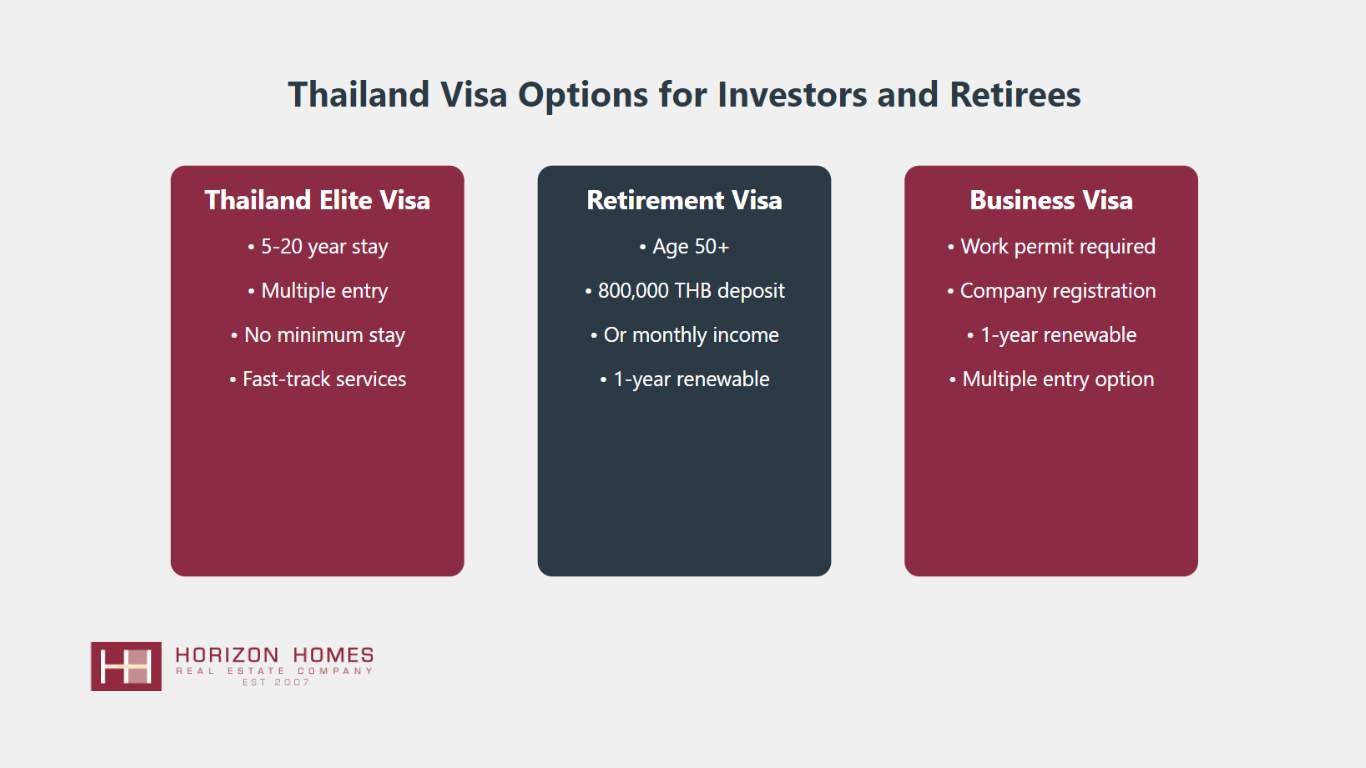

Visa Policy

Thailand offers various long-term visas to accommodate foreign investors and retirees.

Thailand Elite Visas

These visas allow foreigners to stay in Thailand for 5 to 20 years after paying a fee. The Thailand Elite Visa program is designed to attract high net worth individuals and long-term residents.

Benefits of Elite Visas

- Long-Term Stay: Visas allow for extended stays, ranging from 5 to 20 years.

- Attractive to Investors: The program is tailored to high net worth individuals and those seeking long-term residency.

Business, Retirement, Education, and Family Visas

Renewable one-year visas are available for qualified individuals, facilitating long-term residency and investment. Each visa type has specific requirements and benefits.

Types of Visas

- Business Visa: For individuals conducting business in Thailand.

- Retirement Visa: For retirees over 50 years old, meeting financial requirements.

- Education Visa: For students enrolling in Thai educational institutions.

- Family Visa: For family members of Thai residents or long-term visa holders.

Retirement Visa

Individuals over 50 years old can apply for a retirement visa by depositing 800,000 THB or showing high income. This visa is valid for one year and allows multiple entries.

Eligibility and Conditions

Applicants must be over 50 years old and meet the financial requirements, such as maintaining a bank deposit or showing proof of income.

Application Requirements

- Age: Applicants must be 50 years old or older.

- Financial Proof: Either a bank deposit of 800,000 THB or verifiable high income.

Financial Requirements

A deposit of 800,000 THB in a Thai bank or verifiable evidence of high income is required. The deposit can be withdrawn after the visa is granted, provided the minimum balance is maintained.

Maintaining the Visa

- Deposit Withdrawal: The deposited amount can be accessed after visa approval, provided the minimum balance is maintained.

- Multiple Entries: The retirement visa allows for multiple entries, offering flexibility for travel.

Thailand’s Investment Potential

Thailand’s real estate market is attractive to investors from Southeast Asia, China, and beyond.

Popularity in Southeast Asia

Thailand’s real estate market is a primary choice for high net worth individuals from China, Hong Kong, and Singapore. The country’s strategic location and investment-friendly policies enhance its appeal.

Regional Appeal

- High Net Worth Individuals: Attracts investors from China, Hong Kong, and Singapore.

- Strategic Location: Thailand’s location in Southeast Asia offers significant advantages for investors.

Investment Returns

Investors can expect returns of over 7-10%, with guaranteed rental returns of 5%-7%, significantly higher than in many other markets. These returns are driven by the strong demand for rental properties and the growing tourism sector and Horizon Homes Projects typically deliver a 15%+ ROI.

High Returns

- Rental Income: Guaranteed rental returns range from 5%-7%, with potential for higher overall returns.

- Market Comparison: Returns are higher than in many other markets, such as China’s domestic market.

Study Abroad and Medical Tourism

Thailand’s affordable international schools and high-quality medical services attract many foreign investors looking for educational and healthcare opportunities. The country’s reputation as a medical tourism hub further boosts its investment potential.

Educational and Healthcare Benefits

- International Schools: Affordable tuition and high-quality education attract foreign families.

- Medical Tourism: High-quality medical services and affordable healthcare make Thailand a popular destination for medical tourism.

Market Indicators

Thailand’s economic indicators show strong growth and stability, making it an appealing destination for real estate investment.

Economic Growth and Strength

- GDP growth: 4.5% this year, up from 4% last year

- Strong export sector, with annual growth of over 20%

Key Economic Indicators

- GDP Growth: Sustained economic growth with a GDP increase of 4.5%.

- Exports: Robust export sector contributing to economic strength.

Exports and Foreign Capital

- High foreign capital inflows, contributing to economic stability

- Robust industrial output supporting sustained growth

Foreign Investment

- Capital Inflows: High levels of foreign capital investment.

- Industrial Output: Strong industrial sector supporting economic growth.

Tourist Arrivals and External Debt

- Tourist arrivals up by 30%, boosting the hospitality sector

- Low external debt compared to regional peers, enhancing financial stability

Tourism and Debt

- Tourism Growth: Significant increase in tourist arrivals, driving demand for rental properties.

- Low Debt: Thailand’s external debt is low compared to neighboring countries, ensuring economic stability.

Horizon Homes Analyzes Thailand’s Investment Advantages

Horizon Homes highlights the benefits of investing in Thailand, from freehold property rights to the ease of company registration.

Freehold Property Rights

Foreign investors can inherit property rights, offering long-term security. This makes Thailand an attractive destination for investors seeking stable and transferable property ownership.

Benefits of Freehold Rights

- Long-Term Security: Inheritable property rights offer lasting security for investors.

- Attractive Investment: Stability and transferability make freehold properties appealing.

Company Registration Process

Registering a company in Thailand is quick and affordable, facilitating property ownership for foreigners. The process typically takes about seven days and involves minimal costs.

Ease of Registration

- Quick Process: Company registration can be completed in approximately seven days.

- Low Cost: Minimal costs associated with registering and maintaining a company.

Economic Performance and EEC Projects

Thailand’s stable economic performance and ambitious infrastructure projects like the Eastern Economic Corridor (EEC) enhance its investment appeal. The EEC project includes significant developments such as the Sino-Thai Railway, expected to drive economic growth.

Infrastructure and Growth

- EEC Projects: Major infrastructure developments contributing to economic growth.

- Sino-Thai Railway: Significant project enhancing connectivity and investment potential.

Summary of Investment Opportunities

Thailand presents a diverse range of investment opportunities for foreign investors. From luxurious villas in prime locations to affordable condominiums with freehold rights, there are options to suit various investment goals and budgets.

Thailand’s property market is bolstered by strong economic growth, a thriving tourism industry, and supportive government policies. These factors create a favorable environment for foreign investors seeking to capitalize on the country’s real estate potential.

FAQs

Foreigners can buy villas and condominiums, with specific ownership regulations for each type.

Off-plan condos offer lower initial prices, though buyers must be prepared for potential construction delays.

Foreigners can protect their property rights through freehold ownership of condos or by setting up a Thai Ltd Company for villas.

Buyers need to consider the transfer fee, special business tax, and stamp duty, which collectively amount to about 6.3% of the unit price.

A sinking fund is a one-time payment used for future repairs or improvements of the property, calculated based on the condominium’s size.

Yes, Thailand offers various long-term visas, including Thailand Elite visas and retirement visas, for qualified individuals.